Last Updated: January 2026

Choosing the best subscription management and payment processing platform can significantly impact your business’s revenue and efficiency. When comparing Recurly vs Stripe, it’s essential to consider factors like automation, customization, and pricing.

According to recent statistics, the global digital payments market is expected to hit $14.78 trillion by 2027, making the need for a reliable payment solution more critical than ever.

In this article, we’ll dive deep into the Recurly vs Stripe debate, examining their pros and cons to help you determine which platform best suits your business needs.

Overview of Recurly and Stripe

Although both platforms enable online payments, they each serve businesses in different ways. As cash payments are expected to account for less than 10% of the total POS transactions by 2026 with the rise of digital payments. It has become critical for businesses to choose the right payment processor to ensure they are able to stay ahead of the curve.

When comparing Recurly vs Stripe, it’s important to understand their core functionalities and how they serve different business needs.

What is Recurly?

Recurly is a subscription management platform that enables businesses to automate recurring billing, invoicing, and revenue optimization. It tires customers according to several factors to unlock growth, prevent churn, and reduce involuntary churn through advanced dunning management and analytics.

Best suited for SaaS, media, and eCommerce businesses, Recurly integrates with a multitude of payment gateways for flexible payment processing.

Key Highlights of Recurly:

- Recurring billing and invoicing on auto-pilot.

- Dunning management for recovering failed payments.

- Customer insights analytics for subscriptions.

- Multiple payment gateway integration ( for example, Stripe, PayPal, etc.)

- PCI compliant with powerful fraud prevention features.

What is Stripe?

Stripe is a leading payment processing platform with a developer-friendly API and has good customizations in its offerings. While Recurly is primarily a subscription management platform, Stripe is designed to process a variety of transaction types, from one-time payments to complex billing structures.

Businesses that require scalability, international payment support, and seamless integrations often choose Stripe.

Key Highlights of Stripe:

- Allows both one-time and recurring payments.

- API is developer-friendly, so it can easily be integrated into any system.

- Subscription management is handled by Stripe Billing.

- Fraud detection and security with Stripe Radar.

- Multi-currency and global payment support.

Key Features Comparison: Recurly vs Stripe

With the embedded payments market expected to surpass $138 billion by 2026, choosing the right platform is essential for businesses aiming to simplify transactions. Here is a feature-by-feature breakdown:

| Feature | Recurly | Stripe |

| Billing & Subscription Management | Advanced recurring billing & automated dunning management. Allows for various pricing models (flat, pay-as-you-go, tiered). Data-based subscription analytics & churn management. | Standard recurrent billing through Stripe Billing (set up required). No built-in dunning management (You need to implement it manually). Configurable billing but needs developer involvement. |

| Payment Processing & Methods | Compatible with third-party payment gateways (Stripe, PayPal, Braintree, etc.) Accepts payments from Credit/Debit Cards, PayPal, ACH, Apple Pay, and Google Pay. | All-in-one payment processor & gateway. Inscription accepts Credit/Debit Cards, ACH, Apple Pay, Google Pay, Alipay, etc. Provides custom checkout pages & payment links. |

| Integration & Developer Friendliness | Built-in integrations with Salesforce, HubSpot, QuickBooks, NetSuite. APIs need some coding skills. Works as the finest multi-payment gateway extensions. | An API that’s very developer-friendly for custom integrations. Webhooks & SDKs Connects with Shopify, WooCommerce, Saas platforms, etc. |

| Compliance & Security | PCI-DSS Level 1 compliant (secure transactions) Fraud detection by using integrated payment gateways. Data encryption and tokenization. | Compliant PCI-DSS Level 1 (high security). Built-in fraud detection powered by Stripe Radar. It is compatible with 3D Secure, encryption, and tokenization. |

| Global Reach & Currency Support | Supports 140+ currencies and multiple payment gateways. Integrated processors are dependent on international payments. | Live in 46+ countries with 135+ currencies. Provides automated currency conversion & facilities for global payments. |

Pros and Cons of Recurly

Recurly is preferred by subscription-based businesses because of its advanced automation and analytics. Now, let’s explore the Pros and Cons of Recurly.

Pros:

- Automated billing, dunning, and revenue recovery for advanced subscription management.

- Support for various pricing models (fixed, tiered, usage-based, hybrid).

- Out-of-the-box integrations with Salesforce, HubSpot, NetSuite, and QuickBooks.

- Subscription metrics & churn analysis to maximize your revenue.

- Support for multiple gateways and flexibility of payment gateway provider.

Cons:

- You need the integration with third-party alt payment gateways – no inbuilt payment processing

- Costlier than Stripe, making it less suitable for small businesses.

- Less developer flexibility as compared to Stripe’s powerful API.

- Less checkout customisation options for handling payments.

- Global reach is restricted due to dependence on a selected payment gateway for international payments.

Pros and Cons of Stripe

Stripe is a widely used online payment processor that is great for ease of use and developer friendliness. Now let us explore its pros and cons.

Pros:

- A payment processing and gateway solution — with no third-party integrations required.

- API is developer-friendly and has high terms of automation and customization

- It handles payments in 135+ currencies & is available in 46+ countries to help you go global.

- Built-in fraud-prevention tool Stripe Radar and PCI-DSS compliance.

- Offers additional services like Stripe Connect (for marketplaces) and Stripe Atlas (for business incorporation).

Cons:

- Basic subscription management – pretty poor dunning and automation.

- May need to work on new configurations and advanced features

- Fewer out-of-the-box subscription management integrations (vs Recurly).

- Transaction fees generally depend on the processing volume and the respective country, and they can be very high.

- Recurly is more user-friendly than plugins and plays for non-technical users.

Pricing Comparison

When evaluating Recurly and Stripe, understanding their pricing structures is crucial for making an informed decision.

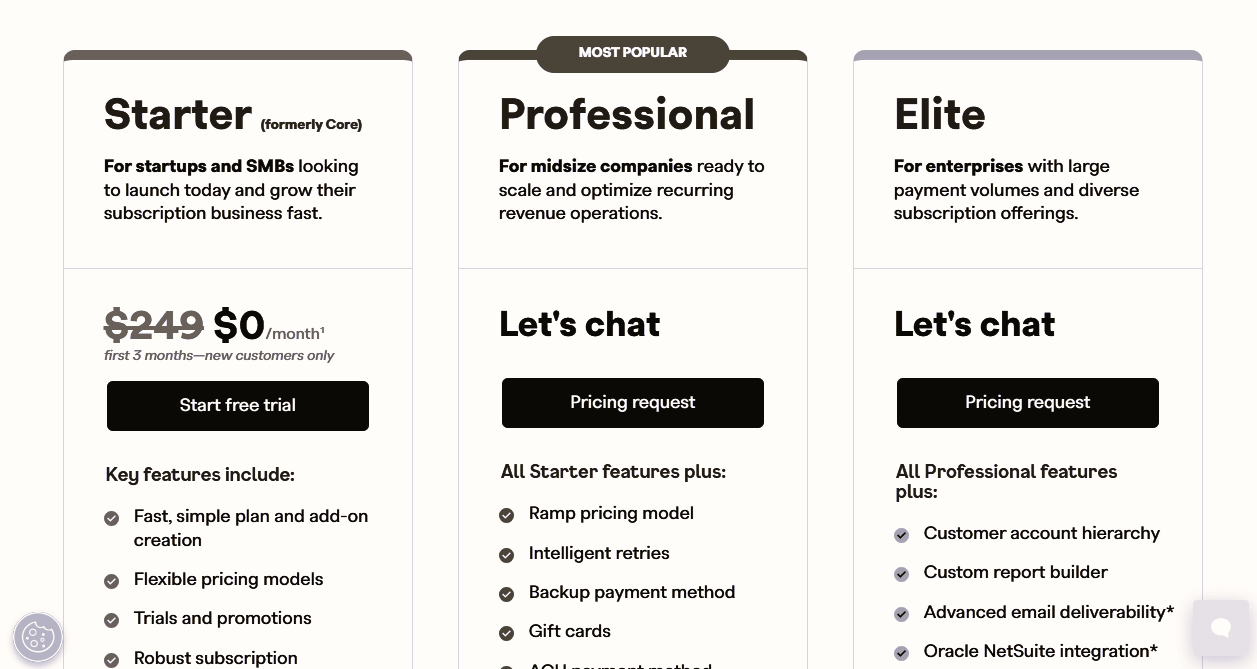

Recurly Pricing:

- Starter Plan: This is for startups and small businesses looking to get their subscription service off the ground and gain traction. This plan costs $249 per month, but there is a promotion for new customers, offering $0 per month for the first three months. Key features include:

- Rapid strategy and add-on development.

- Flexible pricing models.

- Support for trials and promos.

- Extensive subscription management

- Vast language support, more than 30 languages

- Support for more than 40 currencies

- Integration with over 20 payment gateways, including Adyen, Braintree, Cybersource, First Data, and Stripe

- More than 10 payment options supported

- Professional Plan: Designed for midsize organizations prepared to take operations and recurring revenue to the next level. Pricing information for this plan is tailor-made according to specific business requirements, and companies interested in this plan can speak to Recurly’s sales team for a customized quote.

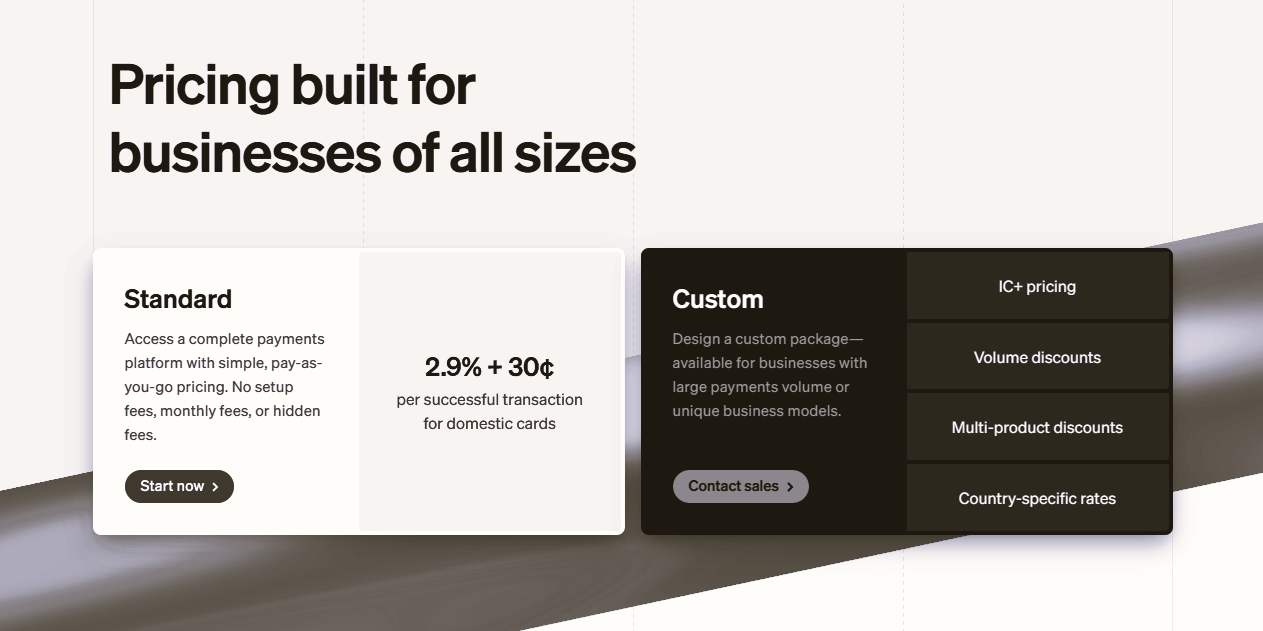

Stripe Pricing:

- Standard Transaction Fees: Stripe uses a pay-as-you-go system with no monthly fees. The standard fee for each successful domestic card transaction is 2.9% + 30¢.

- Link: A check-out shortcut that helps customers seamlessly checkout by pre-filling saved cards and U.S. bank account info. Link Charges 2.9% + 30¢ per successful domestic transaction.

- Buy Now Pay Later: Stripe offers “Buy Now, Pay Later” options through services like Klarna, enabling customers to purchase items and pay in instalments. Fees for this service start at 5.99% + 30¢ per successful transaction.

Which is the Best Digital Payment System: Recurly Vs. Stripe

The debate of Recurly vs Stripe is not a matter of one vs another, you can go for the two together. Recurly also works with Stripe as a Stripe Partner to streamline subscription management while payments are processed through Stripe.

Maybe you love Recurly’s subscription tools but prefer Stripe for your merchant account; in this case, you can add Stripe as a payment processor, one of many payment options compatible with Recurly.

Recurly works best for medium to large companies with subscription models, such as SaaS providers, mobile apps, subscription boxes, streaming, e-learning and digital goods. Its users have increased their subscriber base 100x without increasing involuntary churn.

Whereas Stripe is a singular payment provider, Recurly enables businesses to work with multiple payment providers for further flexibility and additional checkout methods for the customer.

Saufter.io: The Best Email Marketing Automation Software

Saufter.io revolutionizes email marketing with AI-powered automation, making campaigns smarter and more effective. It tracks competitor email strategies and analyzes user behavior to generate personalized campaign suggestions.

For SaaS businesses, it monitors feature usage during trials, identifies key success drivers, and re-engages users with in-app and email nudges. It also suggests industry-specific newsletters to boost engagement.

For e-commerce, Saufter.io triggers campaigns for cart abandonment, purchases, and order updates. It tracks browsing behavior to recommend relevant products, increasing conversions.

With AI-driven insights and automation, Saufter.io ensures better engagement, higher deliverability, and maximized revenue.

Conclusion

When comparing Recurly vs Stripe, both platforms offer robust payment solutions, but the best choice depends on your business needs. Recurly specializes in subscription management with advanced dunning and retention tools, while Stripe provides a flexible, global payment processing system.

With subscription businesses growing 435% over the last decade, selecting the right billing platform is crucial.

While Recurly vs Stripe can handle payments efficiently, integrating them with AI-driven tools like Saufter.io enhances customer engagement. Saufter.io automates personalized email campaigns, helping reduce churn and maximize revenue—ensuring you get the most from your payment platform.