Last Updated: July 2025

When it comes to efficient financial management, the choice between QuickBooks vs Xero can be pivotal for your business success.

In today’s dynamic market, selecting the right accounting software is not just a decision but a strategic investment. QuickBooks and Xero stand as stalwarts in this arena, each offering unique features and benefits.

But how do you decide which one aligns perfectly with your business needs?

Let’s unravel the QuickBooks vs Xero dilemma and guide you toward the ideal solution for your enterprise.

Quickbooks vs Xero Feature Comparison

1. General Ledger

Quickbooks

- User-Friendly Interface: QuickBooks boasts an intuitive interface, allowing users to easily record transactions, manage accounts, and reconcile bank statements.

- Custom Chart of Accounts: Businesses can create a tailored chart of accounts, enabling precise categorization of income, expenses, assets, and liabilities.

quickbooks.intuit.com

“It has a great chart of accounts which is very detailed and can capture as many general ledger accounts as possible.”

⭐ 5/5 Martin M.

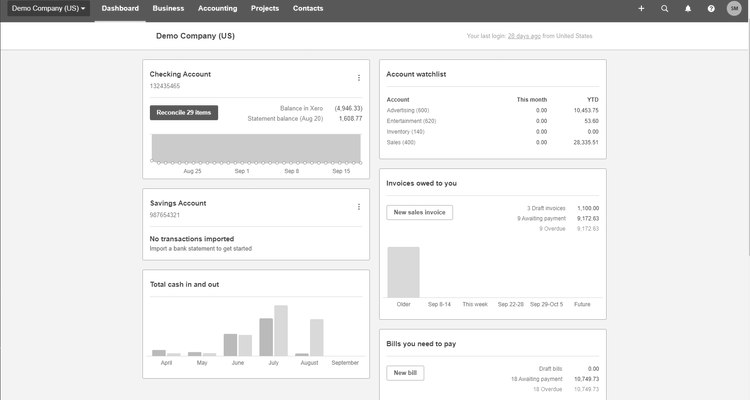

Xero

- Smart Bank Reconciliation: Xero offers automatic bank reconciliation, effortlessly matching bank transactions with corresponding entries in the system.

- Unlimited Transactions: Xero allows unlimited transactions, ensuring scalability for businesses of all sizes.

xero.com

“It also has very useful accounting storage concepts such as charts of account, general ledger reports, etc.”

⭐ 4.5/5 Verified User

2. Accounts Receivable

Quickbooks

- Invoice Customization: QuickBooks enables users to create professional, customizable invoices with logos and personalized messages.

- Payment Reminders: Automated payment reminders help businesses track and follow up on overdue invoices, improving cash flow.

“We use QBO for all of our accounts receivable and expense management.”

⭐ 4.5/5 Alicia H.

Xero

- Online Invoicing: Xero offers online invoicing with built-in payment gateways, allowing customers to pay invoices electronically.

- Invoice Reminders: Xero’s automated invoice reminders gently nudge clients to settle outstanding bills, reducing manual follow-ups.

“Xero is the answer to your accounts receivables and payables mess.”

⭐ 4/5, Verified User

3. Accounts Payable

Quickbooks

- Bill Management: QuickBooks facilitates easy bill entry, tracking, and payment schedules, ensuring timely vendor payments.

- Expense Tracking: Businesses can upload receipts and track expenses, simplifying reimbursement processes.

quickbooks.intuit.com

“This software application allows me to track accounts payable.”

⭐ 4.5/5 Stephan N.

Xero

- Purchase Order Management: Xero allows businesses to create and send purchase orders, streamlining the procurement process.

- Expense Claims: Employees can submit digital expense claims, which can be approved and reimbursed directly through Xero.

xero.com

“You can send customer invoices, as well as view past due invoices, which is ideal as it allows you to track accounts payable, create quotes and commissions on invoices and purchase orders.”

⭐ 5/5, Erica L.

4. Reporting & Analytics

Quickbooks

- Custom Reports: QuickBooks offers customizable reports, allowing businesses to analyze financial data according to specific metrics.

- Profit & Loss Statements: Detailed profit and loss statements provide insights into business performance over time.

“QuickBooks Online provides standard financial reports, such as profit and loss statements and balance sheets.”

⭐ 5/5, Lincoln B.

Xero

- Interactive Reports: Xero’s interactive reports provide a visual representation of financial data, aiding in trend analysis and decision-making.

- Budgeting Tools: Businesses can create budgets within Xero, tracking actual performance against planned financial goals.

“Xero allows you to track your financial performance in real-time, which means you can make informed business decisions quickly and easily.”

⭐ 4/5, Daniel C.

5. Integration

Quickbooks

- Easy Integrations: QuickBooks Online effortlessly connects with various apps like PayPal and Stripe, simplifying tasks such as inventory management and time tracking for small businesses.

- Convenient App Support: With apps like Bill Pay for QuickBooks Online, small business owners can handle invoicing and expenses seamlessly, enhancing their financial management experience.

“It monitors the inventory count and has an integration span that works with various tools and other software, which is excellent for the company to continue its business.”

⭐ 4.5/5, Rose J. W.

Xero

- Wide App Choices: Xero links with 700+ apps, from payments (like Stripe) to inventory and time tracking tools, giving businesses flexible options.

- Versatile Functions: Xero integrates with various apps, including CRM, payroll, and e-commerce, simplifying tasks and enhancing business operations.

“Xero is extremely easy to use and has fantastic integration capabilities for business owners.”

⭐ 5/5, Angie M.

Quickbooks vs Xero Comparison of Pricing

Quickbooks

QuickBooks Online provides a variety of pricing options to cater to different business needs:

- Simple Start: This plan costs $15 per month and is designed for individual users.

- Plus: For $40 per month, this plan accommodates up to five users and offers expanded features.

- Advanced: Priced at $100 per month, this plan supports up to 25 users and provides advanced functionalities tailored for larger businesses.

Regardless of the plan you choose, QuickBooks Online offers essential features such as income and expense tracking, invoicing, payment acceptance, estimates, sales tax tracking, and receipt organization.

If your business requires more advanced capabilities like inventory management, custom user permissions, and accelerated invoicing, upgrading to higher-tier plans will unlock these additional features.

Xero

1. Starter Plan

- Cost: $15 per month

- Features: This plan includes essential features like bank reconciliation, the ability to send quotes and create 20 invoices, and processing 5 bills.

2. Standard Plan

- Cost: $42 per month

- Features: The Standard Plan offers comprehensive tools such as bank reconciliation, invoicing, quoting, bill management, expense tracking, cash coding, online invoicing, and payroll capabilities for up to 2 users.

3. Premier Plan

- Cost: $78 per month

- Features: In addition to all the features in the Standard Plan, the Premium Plan includes support for multiple currencies and automated superannuation processing.

Quickbooks vs Xero Comparison Table

| Feature | QuickBooks Online | Xero |

| General Ledger | User-friendly interface, custom chart of accounts | Smart bank reconciliation, unlimited transactions |

| Accounts Receivable | Invoice customization, payment reminders | Online invoicing, automated invoice reminders |

| Accounts Payable | Bill management, expense tracking | Purchase order management, digital expense claims |

| Reporting & Analytics | Custom reports, profit & loss statements | Interactive reports, budgeting tools |

| Integration | App ecosystem, bank feeds | App marketplace, bank reconciliation automation |

| Pricing | Starts at $15/month for Simple Start, up to $100/month for Advanced | Starts at $15/month for Starter Plan, up to $78/month for Premium Plan |

| Users | Plans vary in the number of users allowed | Plans offer multiple user options depending on the subscription tier. |

That wraps up our analysis of Quickbooks vs Xero, offering valuable insights to aid your decision-making process.

Furthermore, if you need an advanced customer support system that centralizes all your tickets, Saufter.io might be worth exploring.

Saufter.io: Elevate Your Customer Support Experience

Saufter.io revolutionizes the realm of customer support with a steadfast commitment to excellence. This platform seamlessly integrates self-help tools and proactive assistance, empowering your business in unprecedented ways.

Key Features

- Empowering Self-Help: Enable users to discover solutions independently, fostering self-sufficiency.

- Automating Tasks: Streamline processes to boost team efficiency and productivity.

- Enhanced E-Commerce: Elevate satisfaction through automated returns and order adjustments, ensuring a seamless shopping journey.

- Order Tracking: Provide 24/7 order monitoring for a hassle-free shopping experience.

- Omnichannel Connectivity: Engage with customers across diverse platforms, ensuring a uniform experience.

- Effortless Integration: Seamlessly synchronize with popular platforms like Shopify, WooCommerce, Magento, Facebook, and more, ensuring smooth operations.

Conclusion

Opt for Xero if:

- Scalability: Ideal for growing businesses with its flexibility.

- Global Reach: Multicurrency support simplifies international operations.

- User-Friendly: Intuitive interface ensures accessibility.

- Versatile Integration: Offers a wide range of tailored third-party apps.

Choose QuickBooks if:

- Robust Reporting: Detailed insights for comprehensive financial analysis.

- Inventory Focus: Strong inventory tracking features for product-based businesses.

- Industry Specialization: Tailored versions for specific sectors.

- Tax Simplicity: Simplifies tax preparation with dedicated tools.

Consider your business’s unique needs to make the right choice, ensuring efficient financial management and growth.